Related Stories

Reforming Unemployment

International President Tom Buffenbarger

says that state governments need to take a hard look at their unemployment

insurance systems to make sure they are doing the job.

Unemployment Insurance: More

Than Just a Benefit

Unemployment insurance stops recessions from becoming depressions.

Unemployment Insurance:

Will it pay the bills? A laid off IAM member's experience.

Different flavors of unemployment

Understanding the causes of unemployment is vital to combatting it.

Using unemployment as a weapon

Employers have traditionally used unemployment to drive down wages, divide workers, and undermine unions.

They Call This 'Wage Insurance?'

A look at the avearge weekly UI benefits by state and projected solvency of state UI trust funds.

Resources & Contacts

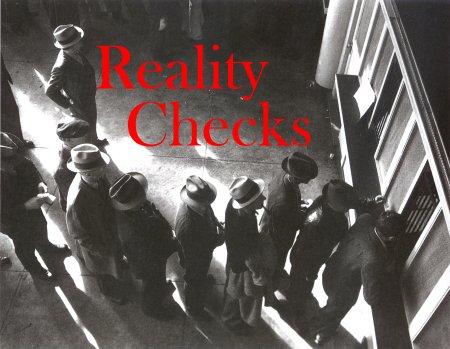

How you can help effect unemployment reform. Get the VideoOrder "Reality Checks" a free IAM-produced video that explores the current state of the nation's unemployment insurance system.

Email your order to IAM Communications

Director Rick Sloan at rsloan@iamaw.org

or call the Communications Department. 301-967-4520.

Dorothea Lange's famous photograph captures the lengthening shadows; the long line of waiting men. The year is 1936, seven hard years after the Crash of '29. The city is San Francisco. And a new state Unemployment Insurance office has opened. The waiting men, if they qualify, will receive between $8 and $15 each week in unemployment compensation.

The photo conveys a mood

-- equal parts resignation and determination -- that can be found in any

employment office today. But there the similarities end.

Lange's photograph contains

no women, no minorities, no temps. It underscores what's wrong with the

current Unemployment Insurance system. UI does not reflect today's workforce.

And it is ill-prepared to meet tomorrow's economic storms.

It's time for a closer look

at this vital worker protection when:

. Fewer than 4 in 10 jobless

workers even receive an unemployment check today.

. Restrictive state laws

exclude millions of part time and temporary employees -- the underpaid

backbone of the "new American workforce."

. U.S. jobless benefits

are among the lowest of any industrial country: so low that in California

and 27 other states, a single head of household with one child on UI lives

below the poverty line.

Most troubling of all, the Unemployment Insurance system itself is in shaky financial condition. As the tough economic times roll in, the benefits people expect -- the benefits they need to survive -- just may not be there.

It is time for a reality

check.

Reality Check #1

UI Cannot Replace Wages

Insurance is supposed to replace

something that has been lost or destroyed. Unemployment Insurance however,

replaces less than half the average worker's pre-layoff income, Department

of Labor figures show.

Each state sets its own benefit levels. The average weekly UI check ranges from a low of $157 in Mississippi to a high of $293 in Massachusetts. Most states pay about $220 per week -- barely enough to cover the mortgage.

U.S. unemployment benefits are among the world's lowest.

No leading industrialized nation pays benefits for a shorter period of time than the 26 weeks paid in the U.S., according to the Paris-based Organisation for Economic Co-operation and Development (OECD).

The U.S. also ranks 12th

among the 18 top industrialized nations in the percent of wages replaced

by UI benefits, the OECD survey showed.

But wages are only part

of the story. The U.S. is the only advanced economy in which workers lose

their health insurance along with their jobs.

Benefits make up 21 percent

of total U.S. compensation costs, and laid off workers can spend $650 a-month

for family health coverage under COBRA.

Reality Check #2

Risk To Working Women

Our UI system was designed for a

workforce U.S. employers abolished decades ago: a work force where one

full-time (male) worker is the sole breadwinner for his wife and children.

That "traditional model" fit 70 percent of all U.S. households in 1940. It fits only 20 percent today, according to the OECD.

The UI system has not kept up with the times, and is failing millions of working women.

Two-thirds of all people entering the U.S. work force today are women. They make up 70 percent of the part-time work force, earn even less than their male counterparts and bear the major burden for child and parental care. Yet,

. Laws in 32 states disqualify

workers who quit due to reasons related to child-care.

. 38 states deny benefits

to workers who quit to follow a spouse whose job is being moved. (At least

90 percent of the disqualified workers are female.)

. Women who quit due to

pregnancy are ineligible for benefits in 21 states.

. Laws in only 13 states

deem it "good cause" to quit a job for reasons related to domestic

violence or spousal abuse.

These discriminatory provisions directly harm working women, and need to be rewritten by state legislatures.

But the real travesty is

the way UI is failing millions of women and men in the fastest-growing,

most exploited segment of the modern American work force -- the "so-called"

contingent employees.

Reality Check #3

Part-timers and Temps

Need Not Apply

Part time workers, temporaries, seasonal

employees and independent contractors make up at least one-third of the

current U.S. labor force.

Typically the "first fired" in an economic downturn, these contingent workers are often denied UI because of their intermittent hours and low pay. And when they can collect, their benefits are often too low to live on.

Part time workers, for example, comprise at least 20 percent of the U.S. workforce, but only 12 percent ever receive a UI check.

A mind-bending maze of "Catch 22s" works against the new contingent work force.

Suppose a temporary worker accepts a six-month job from a temp agency, is laid off at the end of the assignment and applies for UI. In all but five states, the worker would be ineligible to collect. By accepting a job of known duration, the worker is branded a "voluntary quit."

Laws in half the states keep people trapped in an endless cycle of temporary employment. Once you complete a temporary job, forget about launching a full-time search for good-paying permanent employment. You must contact the temp agency for another temporary assignment or be declared ineligible for UI as a "voluntary quit." In these states, once a temp always a temp.

Low wages and irregular work are the biggest barriers, responsible for 20 percent of all cases where workers are declared ineligible for UI, according to the National Employment Law Project (NELP).

For example, someone making $5.15 an-hour (the federal minimum wage), laid off after 20 weeks, would fail the minimum earnings test for UI in 13 states. But someone making $10 an-hour, laid off after working the same 20 weeks, would qualify for UI in all but one state.

This poses huge problems,

particularly in light of the 6.5 million people who have entered the lowest-paying

rungs of the labor market since the old welfare system was abolished in

1996. According to a recent report in the National Journal, only 25 percent

of these former welfare recipients would qualify for UI benefits if they

were laid off today.

Next/Contents