The growing gap in life expectancy will affect your retirement benefits under the Social Security and Medicare programs and the policies meant to protect them. A new study by the National Bureau of Economic Research (NBER) found that older Americans have experienced dramatic gains in life expectancy in recent decades, but most of the gains have only been realized by those at the top of the income distribution.

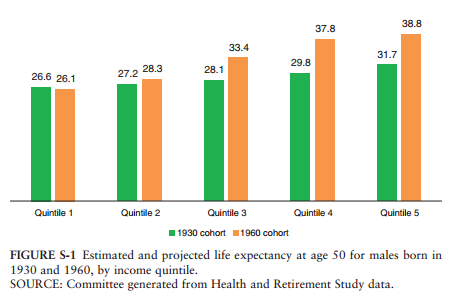

NBER reports that life expectancy at age 50 for males in the two highest income quintiles will rise by 7 to 8 years between the 1930 and 1960 birth cohorts, but that the two lowest income quintiles will experience little to no increase over that time period.

Specifically, for men it is projected that the gap in life expectancy at age 50 between the highest and lowest quintiles of lifetime income will grow from 5 years for those born in 1930 (27 years for lowest income quintile vs. 32 years for the highest) to nearly 13 years for those born in 1960 (26 years vs. 39 years).

Estimates for women are somewhat less reliable, but show a similar if not larger change over time. The top quintile is the 20% of the population with the greatest income, and the bottom quintile is the lowest 20% by income.

Growing inequality in life expectancy has serious implications for lifetime benefits from Social Security, Medicare and other programs. NBER calculated that the differences in life expectancy will cause the gap between average lifetime program benefits received by men in the highest and lowest income quintiles to widen by $130,000 (in 2009 dollars) for those born in 1960 compared to 1930.

NBER took the life expectancy data and looked at possible changes to Social Security and Medicare. Some of the policies, such as raising the full retirement age for Social Security and the eligibility age for Medicare, are favored by Congressional Republicans. NBER looked at which income groups would lose the most from these policies. Other possible changes were also examined.

Raising the Medicare eligibility age by two years, from 65 to 67, make benefits less progressive — meaning that it takes a proportionally greater amount from those with lower incomes.

Raising the normal retirement age from 67 to 70 would cause lifetime Social Security benefits to fall by 25% of their pre-reform value for the lowest quintile of males in the 1960 birth group, and by 20% for the highest quintile, making it, too regressive by one key measure.

Raising the EEA (early eligibility age) for Social Security beneficiaries from 62 to 64 would also take a proportionally greater amount from those with lower incomes.

The life expectancy data provide further evidence that raising the full retirement age for Social Security from 67 and 70, and the Medicare eligibility age from 65 to 67, are particularly unfair to those at the lower end of the economic ladder.

The post Growing Gap in Life Expectancy Will Affect Your Earned Retirement Benefits appeared first on Retired Americans.